November 17, 2025

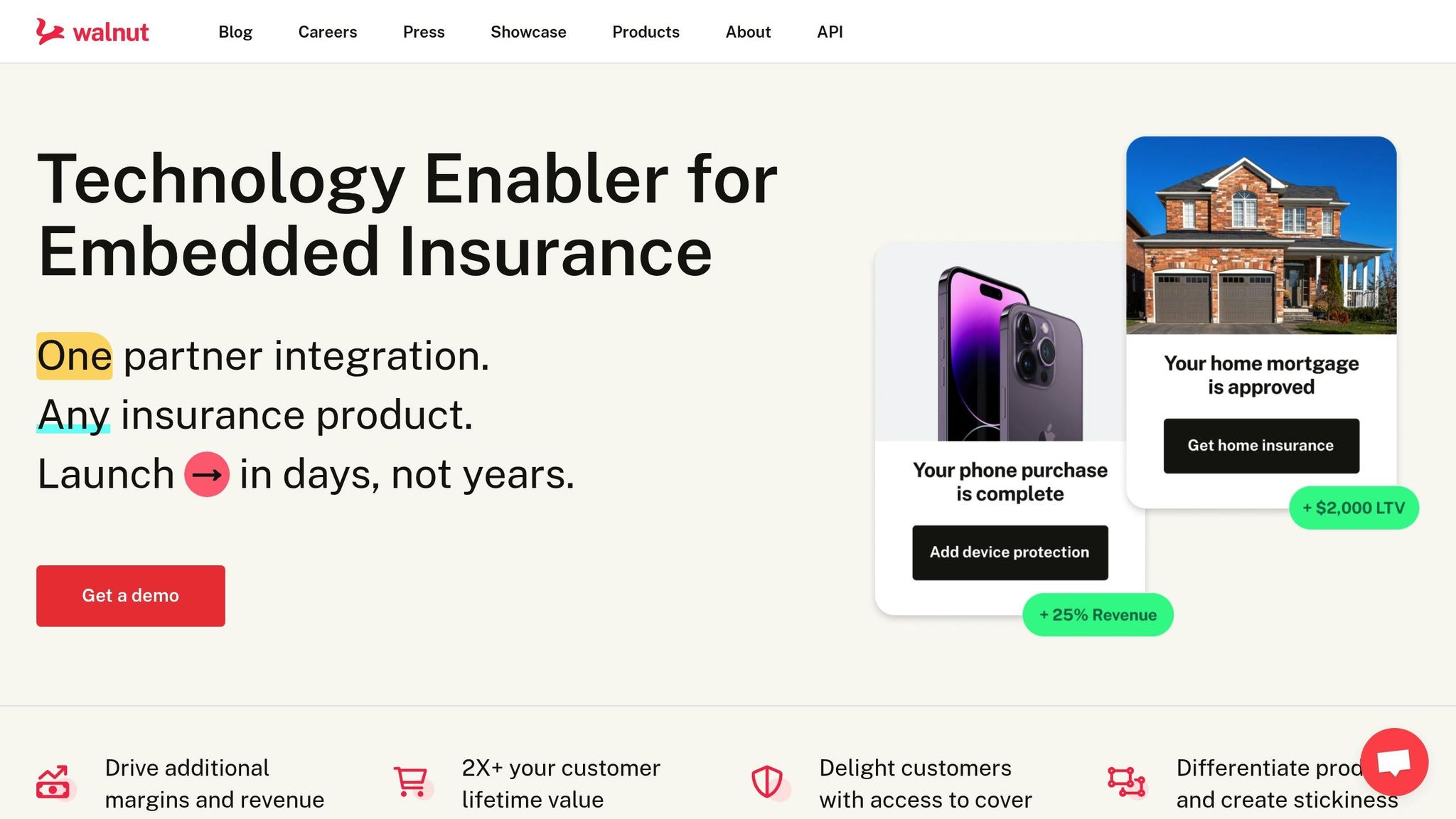

Embedded insurance is changing the way businesses offer coverage by integrating it directly into digital platforms. This approach eliminates the hassle of traditional insurance processes, making it easier for customers to get coverage at the right time - like during a purchase or service sign-up.

Key highlights:

Platforms like Walnut Insurance offer flexible options for businesses of all sizes, from simple co-branded links to fully integrated APIs. This trend is creating new revenue streams, improving customer loyalty, and simplifying compliance for U.S. companies.

Embedded insurance isn't just a feature - it's becoming a core part of how businesses deliver value.

The embedded insurance market is growing rapidly on a global scale. Analysts predict continued expansion as advancements in digital infrastructure and new distribution methods allow insurers to integrate products directly at the point of sale. Unlike the traditional, often time-consuming processes, embedded insurance simplifies things by bundling coverage during the purchase process, making it easier to drive revenue. In North America, the combination of advanced technology platforms, supportive regulations, and strong consumer demand has positioned the region as a leader in this space.

These promising numbers reflect a shift in both industry strategies and consumer behaviors.

Adoption rates for embedded insurance differ across industries. Electronics protection currently leads the way, but other sectors - such as automotive and retail - are increasingly exploring integrated insurance solutions. On the consumer side, preferences have shifted toward digital platforms, especially among younger users who are comfortable making transactions through apps. This has pushed insurance providers to roll out embedded offerings that not only lower customer acquisition costs but also attract significant investments from the growing insurtech sector.

Regional trends show that North America’s well-established ecosystem supports strong adoption among both consumers and merchants. Early movers in areas like device protection, auto insurance, and travel insurance are particularly well-positioned to meet shifting consumer demands as the industry leans further into digital-first distribution models.

These trends highlight the importance of robust, API-powered solutions to seize the opportunities emerging in this evolving market.

APIs play a crucial role in seamlessly integrating insurance products into digital platforms. Imagine you're shopping online or booking a ride-sharing service - APIs make it possible to receive real-time insurance quotes and even bind policies within seconds, all without leaving the platform.

Here's how it works: APIs act as secure bridges between a business's systems and insurance providers. At key moments during a transaction, the API pulls relevant data - like product value, customer location, or risk factors - to instantly generate an insurance quote. This all happens in the background, ensuring a smooth and efficient experience for the customer.

Beyond quotes, APIs also handle tasks like policy administration, claims processing, and compliance reporting. By automating these processes, they reduce manual work and ensure accurate, uninterrupted data flow.

Walnut Insurance takes API integration to the next level by offering flexible solutions tailored to different technical needs. They provide three distinct approaches, ensuring businesses of all sizes can integrate insurance offerings effectively:

Walnut’s platform is built for speed and convenience. Customers can get instant quotes and finalize insurance purchases during the same session as their primary transaction. Plus, the system helps U.S. businesses navigate complex state-by-state regulatory requirements, making compliance much easier to manage.

These integration options reflect the growing trend toward effortless, embedded insurance solutions.

Emerging technologies are further boosting the efficiency of API-driven insurance systems. Artificial intelligence (AI) is a game-changer, automating underwriting and tailoring coverage by analyzing customer data in real time. Meanwhile, telematics is revolutionizing auto insurance pricing by using real-world driving data.

A great example is Tesla Insurance, launched in 2019. Tesla uses telematics to price policies for certain models based on actual driving behavior and data collected through the vehicle’s built-in sensors. This approach highlights how technology can make insurance more personalized and efficient.

Together, these advancements are pushing the boundaries of what’s possible in embedded insurance, making it smarter and more intuitive than ever before.

Online retailers are stepping up their game by embedding device protection directly into the checkout process. Offering real-time quotes for extended warranties or accidental damage coverage makes purchasing easier and more appealing for customers. Platforms like Walnut simplify this integration, ensuring policies are activated smoothly and meet compliance standards. This approach not only enhances the shopping experience but also builds customer loyalty and boosts revenue.

Digital banking platforms are following suit by embedding insurance options within their services. Many now include protections like travel insurance or identity theft coverage as part of premium account packages. Walnut’s technology ensures seamless enrollment and activation, creating a hassle-free experience for customers. This strategy strengthens customer satisfaction while offering banks a way to stand out in a competitive market.

Mobility platforms are also tapping into embedded protection by offering tailored auto insurance based on real-time driving data. Using telematics, these platforms adjust premiums dynamically according to driving behavior. Walnut’s Headless API enables instant quotes, policy activation, and compliance with regulations, making the process efficient and user-friendly. For mobility companies, this means better operational efficiency and an improved experience for their users, all while driving customer loyalty and long-term growth.

Embedded insurance is reshaping how businesses in the U.S. generate revenue, retain customers, and manage compliance. By integrating insurance directly into their offerings, companies can unlock benefits that go beyond traditional models.

The concept of "Protection-as-a-Service" is opening up new revenue opportunities across various industries. By embedding insurance products into customer journeys, businesses can see a noticeable boost in revenue - often within the first year - through commissions on policies sold.

This approach works especially well in high-transaction sectors like e-commerce and digital banking. For example, integrating insurance into transactions not only increases revenue per purchase but can also encourage premium account upgrades. Companies leveraging platforms like Walnut's API-driven solutions gain access to competitive rates while maximizing their commission potential, creating a steady flow of recurring income from premiums.

This steady revenue stream underscores how embedded insurance aligns with broader business strategies, offering financial predictability and growth.

Embedded insurance doesn’t just drive revenue - it strengthens customer relationships. By seamlessly integrating insurance into existing platforms, businesses make life easier for their customers. No one enjoys the hassle of shopping for separate coverage, and the convenience of having insurance right where they need it fosters trust and satisfaction.

This added value often translates into better customer retention. For instance, mobility companies offering auto insurance as part of their services often find that insured users are more likely to stick with the platform. Additionally, well-timed and relevant insurance options can improve customer advocacy metrics like Net Promoter Scores, leading to more referrals and positive reviews.

When customers feel protected and valued, they’re more likely to engage with a brand over the long term, boosting their lifetime value.

Modern embedded insurance platforms also streamline operations, reducing the administrative burden often associated with traditional insurance processes. Tasks like underwriting, policy issuance, and claims management, which typically require significant manual effort, are automated through API-driven solutions like Walnut's Headless API. This not only speeds up processing but also cuts operational costs.

In the U.S., where insurance regulations vary by state, compliance can be a challenge. Embedded insurance platforms handle these complexities automatically, ensuring businesses stay compliant across multiple jurisdictions without needing dedicated legal teams. This is particularly important in a regulatory environment as intricate as the U.S.

Automation also delivers cost savings by eliminating the need for specialized insurance staff or separate compliance systems. As businesses scale - whether by entering new states or handling higher transaction volumes - these platforms can easily adapt without creating bottlenecks.

Another advantage is improved risk management. With real-time data integration, modern platforms can dynamically adjust coverage and pricing based on current risk factors. This not only protects the business but also ensures customers receive fair and accurate pricing, making the entire process more efficient and reliable.

Embedded insurance is proving to be a game-changer, offering U.S. companies a way to grow revenue, enhance customer loyalty, and navigate complex regulatory landscapes with ease.

Protection-as-a-Service is reshaping how businesses operate by merging value with protection in a way that feels seamless. Companies adopting embedded insurance are finding new ways to generate revenue, build stronger connections with their customers, and simplify operations - achievements traditional insurance models struggle to deliver.

The data shows a clear trend: businesses, especially in the U.S., are increasingly incorporating insurance directly into their offerings. Modern platforms make this possible by automating compliance and offering scalable, API-driven solutions that simplify the process.

What drives this shift is the win-win nature of embedded insurance. Customers enjoy the ease of integrated protection without needing to shop separately, while businesses benefit from steady revenue streams and stronger customer loyalty. Over time, operational efficiencies compound, creating a foundation for growth. This is where industry leaders like Walnut Insurance are making an impact.

Walnut Insurance is leading the charge with a platform that connects businesses to over 14 carriers. It provides flexibility, from co-branded links to fully customizable APIs, all while ensuring compliance with state regulations. These tools empower businesses to thrive in the Protection-as-a-Service landscape.

As customer expectations grow and technology continues to make integration easier, embedding protection into core services will shift from being a competitive edge to an essential business practice. Companies that act now and embrace embedded insurance will be positioned to stay ahead in this evolving market.

Embedded insurance weaves coverage directly into the purchase of a product or service, making the process seamless and hassle-free for consumers. Instead of dealing with the often tedious and separate steps of traditional insurance, this type of coverage is conveniently offered right at the point of sale.

For businesses, this approach boosts customer satisfaction and strengthens loyalty. Meanwhile, consumers benefit from convenience, tailored choices, and, in many cases, cost savings. It’s a straightforward way to simplify insurance and make it quicker and easier to access.

APIs are the backbone of embedding insurance into digital platforms, facilitating smooth communication between different systems. They allow businesses to integrate insurance products directly into their apps or websites without causing any interruptions to the user experience.

With APIs, companies can offer personalized insurance options at key moments in the customer journey - like during checkout or while setting up an account. This approach boosts convenience and strengthens trust by providing relevant protection exactly when customers are likely to need it.

Implementing embedded insurance comes with its fair share of challenges. For starters, businesses have to navigate a maze of regulatory requirements, including state and federal insurance laws. This might mean licensing employees or adhering to strict data privacy standards. On top of that, keeping the customer experience smooth can be tough, especially if claim disputes arise with the insurer.

To tackle these hurdles, businesses should focus on a few key areas:

By addressing these areas, companies can create an embedded insurance experience that's compliant, efficient, and keeps customers happy.