Looking for personal insurance?

Walnut for consumers

Get more information about our embedded insurance solutions today.

Drive additional margins and revenue

2X+ your customer lifetime value

Delight customers with access to cover

Differentiate products and create stickiness

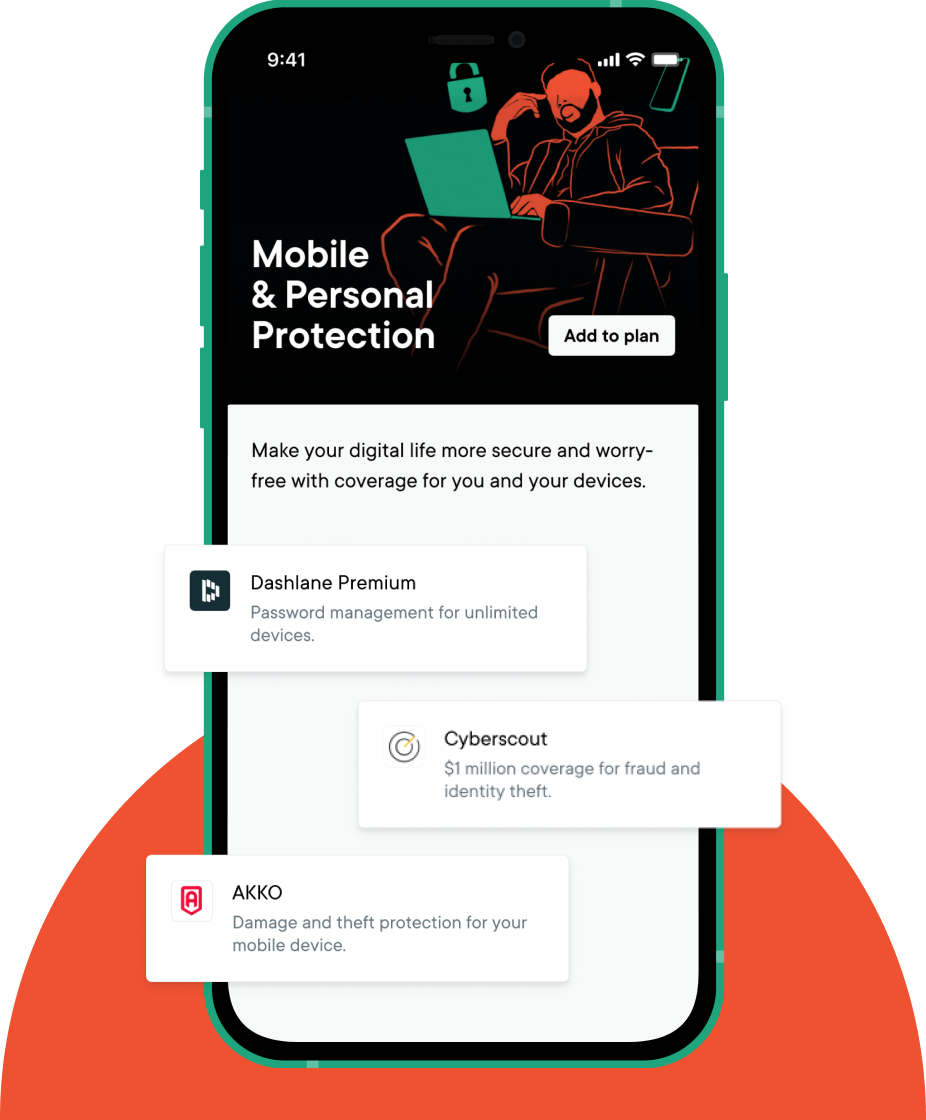

Launch an in-platform branded insurance program, no insurance experience required.

Best-in-class customer journeys that look and feel like your experience.

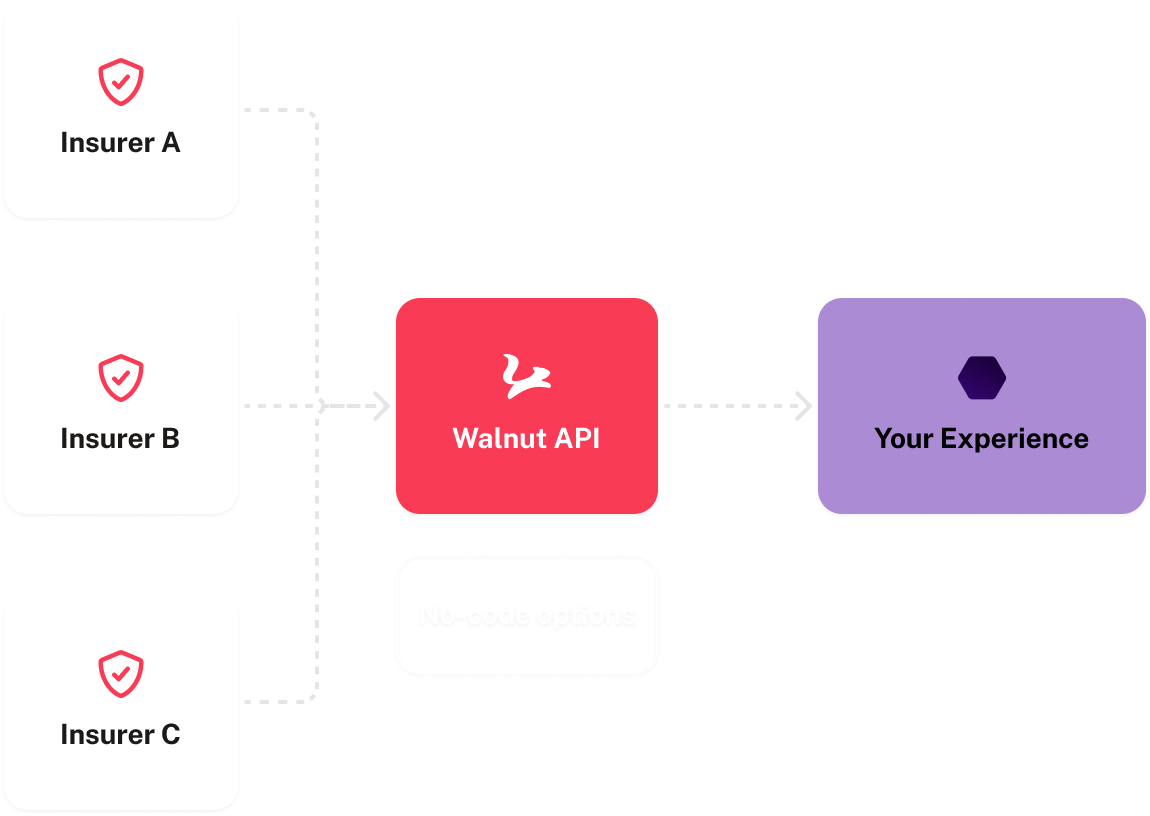

We integrate with insurers to provide you with easy-to-deploy integration options.

We provide full-serve licensing paired with multi-channel broker support for you customers.

Some of our Trusted Partners

Additionally, we have no-code integration options available to get you off the ground in under a day.

Get a demo

Over 14 carriers to give you access to products that fit your customers' needs.

About Neo Financial

Canada’s fastest growing neo-bank with over 1M customers across their credit card, savings account, investment, and mortgage products.

What we embedded

Credit Card Insurances

Extended warranty, rental insurance, purchase protection, and more!

Premium Plan offerings

Mobile phone protection, life insurance, health and wellness benefits

Testimonial

"We’re excited to partner with Walnut, bringing insurance into the digital age and creating greater access to protection for all Canadians. We’ve been impressed with how their infrastructure has been able to support us in growing our product offering."

Andrew Chau

Co-founder & CEO

We’ve integrated with insurers so that you can get up and running in day.

01

Choose the most relevant products for your customer base.

02

Integrate insurance into your offering with our APIs or no-code solutions.

03

View your dashboards as customers enroll and get protected.

Get more information about our embedded insurance solutions.

Get a demo today!